Good Bye and Good Riddance (?) to "the Maestro"

Editor's Note: Originally posted at THE FAIRBANK REPORT on 04 November 2005 (See the 11/4/2005 entry at this Fairbank Report.)

By B G Phan

Mr. Phan is Senior Editor and Economics Correspondent of The FAIRBANK REPORT.

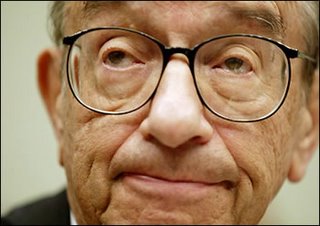

Good bye and perhaps good riddance to Federal Reserve Bank Chairman Alan Greenspan. He is scheduled to leave the Fed at the end of January 2006. Sycophants in government and the mass media have hailed him as "the maestro," "the genius" and other equally nauseating, honey-dripping terms of endearment.

Let's look at his recent records to see if these accolades are justified. In 1996, Greenspan correctly foresaw the "irrational exuberance" of an overheated, speculative stock market. Yet, he did nothing to cool down the market. A few interest rate hikes in 1997, 1998 and 1999 might have avoided the crash of the stock market from 2000-2003. In fact, Greespan probably exacerbated the 2000-2001 recession by belatedly and continuously raising rates after the March 2000 bubble had burst. It was only after the attacks of 9/11/2001 that the Fed began to cut interest rates.

And then there's his recent "froth" in the real estate market commentary. Duh!, as the Valley Girl would say. Under his chairmanship, the Fed has failed to regulate the banks and other financial institutions, which have been pushing dangerous exotic loans, e.g., interest-only, piggy-back, 100%+-financing mortgage loans. In overheated housing markets such as California, Boston and New York, these creative financing schemes now account for the majority of outstanding loans! People who have no business buying houses are purchasing them at enormously inflated prices. After all, it's not their money; they're playing with OPM, other people's money.

The housing bubbles in California, Boston and New York will burst. And the consequences and ramifications will be ten folds worse than the bursting of the Nasdaq bubble. Yet, Dr. Greenspan, "the maestro"--nay "the genius"--has done very little to prevent excesses in the housing markets by reining in rogue lenders.

Even if the Fed acts aggressively today, it is a day late and a dollar short. The upcoming housing bubble-induced recession, perhaps even a small depression, should be called Economic Hurricane Alan in honor of the maestro, and like other hurricanes, this one will pack a wallop and cause a world of hurt...